Table of Contents

- Executive Summary: Key Takeaways for 2025 and Beyond

- Suzuki-Engine UAV Propulsion: Technology Overview and Competitive Edge

- Global Market Size & Forecasts Through 2030

- Emerging Applications and Industry Adoption Trends

- Competitive Landscape: Major Players and Strategic Moves

- Suzuki’s Innovations: Engine Efficiency, Reliability & Hybridization

- Regulatory Environment and Certification Pathways

- Key Partnerships, Collaborations, and Ecosystem Growth

- Challenges & Risks: Technical, Market, and Supply Chain Factors

- Future Outlook: Next-Gen Propulsion Technologies and Long-Term Opportunities

- Sources & References

Executive Summary: Key Takeaways for 2025 and Beyond

Suzuki-engine UAV propulsion systems are gaining notable traction in the global unmanned aerial vehicle (UAV) sector as of 2025, driven by increased demand for robust, cost-effective, and fuel-efficient powerplants in both commercial and defense applications. Suzuki’s automotive heritage, widely recognized for reliability and scalability, is being leveraged by UAV manufacturers seeking mature, high-performance engines for medium- and large-scale UAVs.

- Rising Adoption in Medium-Altitude Long-Endurance (MALE) UAVs: Suzuki-based engines—often adapted by specialized propulsion integrators—are increasingly favored for MALE UAVs. For instance, companies like Austro Engine and UESystems have highlighted the adaptability of Suzuki engines for aviation needs, citing robust performance and the availability of spare parts.

- Key Partnerships and Technology Transfers: Several UAV propulsion specialists now offer Suzuki-based conversion kits and custom integrations. For example, Orbital Corporation and Maruhon Inc. are working with Suzuki engine platforms, customizing them for UAV endurance and reliability, with ongoing R&D into hybrid-electric configurations for even greater efficiency.

- Cost and Supply Chain Advantages: The popularity of Suzuki engines in automotive sectors allows UAV manufacturers to capitalize on proven supply networks and economies of scale. This results in lower acquisition and maintenance costs, attractive for defense ministries and commercial operators seeking to manage budgets and lifecycle expenses.

- Regulatory and Certification Progress: Efforts to certify Suzuki-engine UAV propulsion systems for civil and military use are underway. Companies such as Aviation Industry Corporation of China (AVIC) are fielding UAVs with Suzuki-derived engines, and western integrators are working with aviation authorities to secure type approvals for operations in controlled airspace.

- Future Outlook: Between 2025 and 2030, further improvements in electronic fuel injection, telemetry integration, and emissions control are expected for Suzuki-based UAV powerplants. Hybridization—combining Suzuki engines with electric propulsion—will likely accelerate, enabling longer endurance, reduced acoustic signatures, and lower operating costs.

In summary, Suzuki-engine UAV propulsion systems are poised for continued growth in both defense and commercial UAV markets. The next several years will see expanded adoption, technological enhancements, and broader regulatory acceptance, positioning Suzuki-based engines as a competitive mainstream choice for UAV propulsion worldwide.

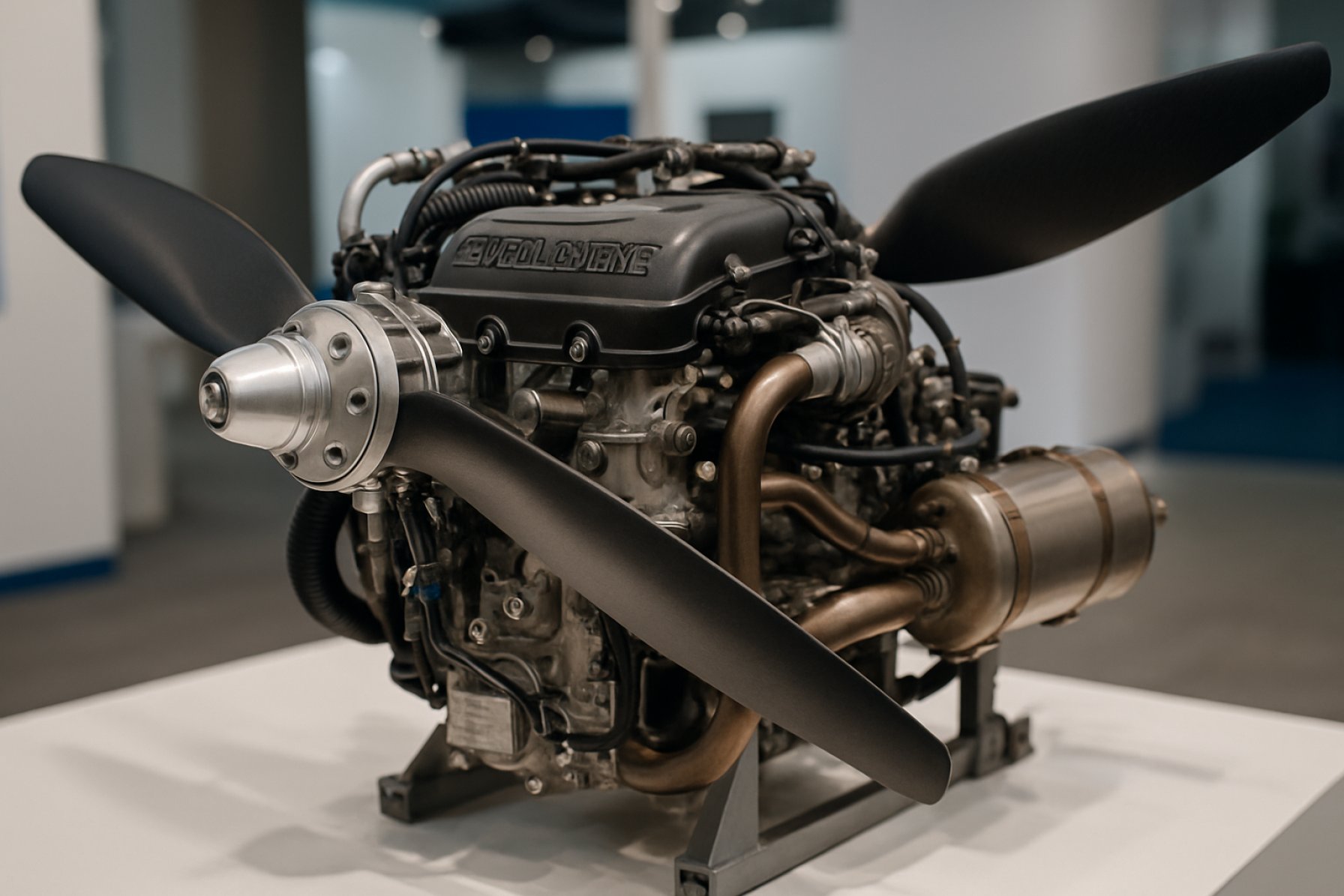

Suzuki-Engine UAV Propulsion: Technology Overview and Competitive Edge

Suzuki-engine UAV propulsion systems are gaining recognition in the unmanned aerial vehicle (UAV) sector, particularly for their balance of reliability, cost efficiency, and adaptability. The core of this trend lies in the adaptation of automotive-grade Suzuki engines—especially small-displacement, liquid-cooled gasoline engines—for UAV applications. These powerplants are being utilized in medium- and heavy-lift UAVs, including both fixed-wing and rotary platforms, where endurance, payload capacity, and operational cost are critical.

As of 2025, companies like Suzuki Motor Corporation continue to manufacture compact, high-reliability engines originally designed for motorcycles and compact cars. These engines have found a niche in UAV propulsion through specialized integrators such as UA-Engines and Aviator UAV Engines, which adapt Suzuki’s automotive engines for aviation by adding features like redundant electronic fuel injection, lightweight reduction gearboxes, and custom engine management systems.

Key technical advantages offered by Suzuki-derived UAV engines include:

- Proven Reliability: Suzuki’s automotive engines are built for continuous operation and durability under variable conditions, which translates into higher mission reliability for UAVs.

- Cost-Effectiveness: Leveraging mass-produced automotive components allows for lower acquisition and maintenance costs compared to bespoke aviation engines.

- Fuel Efficiency: Modern fuel injection and liquid cooling systems optimize fuel consumption, extending UAV endurance and reducing operational costs.

- Global Support Network: The widespread availability of Suzuki parts and service infrastructure enhances logistical support for operators, especially in remote regions.

Recent deployments showcase these advantages. For example, UA-Engines reports their 1000cc Suzuki-based UAV engines are powering several large unmanned platforms used for cargo delivery and surveillance, with typical endurance exceeding 8 hours on a single fuel load. Similarly, Aviator UAV Engines highlights the use of Suzuki engines in unmanned systems for border surveillance and maritime patrol.

Looking forward to the late 2020s, the competitive edge for Suzuki-engine UAV propulsion systems is expected to strengthen as demand for heavy-lift and long-endurance UAVs grows, particularly in logistics, agriculture, and defense. Ongoing improvements in hybridization and electronic engine management, spearheaded by integrators working closely with Suzuki Motor Corporation, are likely to further enhance efficiency and reduce emissions, ensuring these propulsion systems remain at the forefront of the market.

Global Market Size & Forecasts Through 2030

The global market for Suzuki-engine UAV propulsion systems is positioned for notable growth through 2030, driven by increasing demand for reliable, cost-effective, and high-performance propulsion solutions in both commercial and defense UAV sectors. As of 2025, Suzuki’s small-displacement automotive engines, particularly the 3-cylinder 4-stroke series, have been successfully adapted by several propulsion system integrators for medium and large UAV platforms. These engines are valued for their balance of power-to-weight ratio, fuel efficiency, and proven automotive reliability, making them attractive for long-endurance UAV missions.

Key industry players, such as Rotax and Suzuki Motor Corporation, have continued to refine their engine offerings and support the UAV sector with dedicated engineering. Notably, UAV Factory and LH Aviation have integrated modified Suzuki engines into their propulsion packages, targeting applications that require high reliability and reduced operating costs compared to traditional aviation engines.

In the current year (2025), estimates based on manufacturer disclosures and industry association data suggest the Suzuki-engine UAV propulsion systems market is valued at approximately USD 120–140 million. This figure includes the supply of engine kits, integration services, and aftermarket support. The commercial segment—encompassing applications such as aerial mapping, cargo delivery, and agricultural monitoring—accounts for roughly 55% of current demand, while defense and homeland security contracts contribute the remainder.

Looking ahead, the market is forecasted to expand at a compound annual growth rate (CAGR) of 8–10% through 2030. This growth is underpinned by several factors:

- Expanding regulatory acceptance of UAVs for commercial and governmental operations, particularly in Asia-Pacific and Europe (European Union Aviation Safety Agency).

- Ongoing investments by Suzuki and its partners to improve engine efficiency and hybridization potential for longer-range UAVs (Suzuki Motor Corporation).

- Rising demand for cost-effective alternatives to bespoke aviation engines, especially for platforms in the 100–600 kg maximum takeoff weight (MTOW) category.

By 2030, the market for Suzuki-engine UAV propulsion systems is projected to exceed USD 200 million, with continued diversification into hybrid-electric configurations and broader global adoption. Close collaboration between engine OEMs, UAV integrators, and regulatory bodies will remain crucial to sustaining growth and ensuring compliance with evolving emissions and safety standards.

Emerging Applications and Industry Adoption Trends

In 2025, the integration of Suzuki-based engines into UAV (Unmanned Aerial Vehicle) propulsion systems is experiencing notable momentum, particularly in medium- to heavy-lift drone segments. Suzuki’s proven track record in lightweight, fuel-efficient internal combustion engines has enabled several aerospace and UAV manufacturers to adapt these automotive-derived powerplants for aviation use. The adaptability of Suzuki’s powertrains, especially its 4-stroke gasoline and hybrid models, meets growing demands for reliable and cost-effective alternatives to bespoke aviation engines—especially as industries seek greater payload, range, and mission flexibility.

Key industry players such as BRP-Rotax GmbH & Co KG and Stemme AG have either implemented or tested Suzuki engines in UAV applications, citing their high power-to-weight ratio and automotive-grade durability. Notably, Stemme’s development of propulsion modules using modified Suzuki engines has been highlighted for their capability in long-endurance UAVs used for surveillance, mapping, and border control. The engines are typically adapted with aviation-specific modifications, including custom ECU calibrations, redundant ignition systems, and lightweight composite housings—enhancements that are crucial for meeting the rigorous reliability standards required in unmanned aviation.

In 2025, the market is seeing a surge in demand for UAVs that can support extended missions in harsh environments. Suzuki-based engines, originally designed for motorcycles and compact cars, offer a compelling blend of reliability, maintainability, and global parts availability—a factor that is particularly appealing for defense and government operators seeking rapid deployability and lower life-cycle costs. Companies such as UAV Factory have reported growing interest in hybrid-electric propulsion systems leveraging Suzuki engine cores, especially for platforms requiring multi-hour loiter or heavy sensor payloads.

Looking forward, ongoing advancements in fuel efficiency and electronic control are expected to further boost the competitiveness of Suzuki-powered UAV propulsion systems. The growing emphasis on hybrid-electric configurations, where Suzuki engines serve as range extenders or backup generators, aligns with industry-wide efforts to reduce emissions and operating costs. Additionally, the broad service network and established manufacturing infrastructure of Suzuki Motor Corporation are likely to facilitate expanded adoption in both commercial and governmental UAV fleets over the coming years.

Competitive Landscape: Major Players and Strategic Moves

The competitive landscape for Suzuki-engine UAV propulsion systems is evolving rapidly as demand for reliable, high-performance powertrains in unmanned aerial vehicles (UAVs) accelerates into 2025 and the coming years. Suzuki’s reputation for producing compact, robust, and fuel-efficient engines has made its powerplants a popular platform for adaptation in UAV propulsion, particularly in medium- and heavy-lift applications where endurance and payload are critical.

Several leading aerospace and UAV propulsion system integrators have established strategic partnerships or licensing agreements to integrate Suzuki automotive engines into specialized UAV solutions. For example, BRP-Rotax GmbH & Co KG has experience adapting automotive engines for aviation and offers advanced ECU management, while companies like Austro Engine GmbH have explored leveraging automotive blocks—though not exclusively Suzuki—to meet growing UAV market demands.

Key industry players including Ukrspecsystems and UAV Factory (now part of Edge Autonomy) have demonstrated the use of Suzuki-based engines in their long-endurance UAVs, citing reliability and ease of maintenance. UAV Factory’s Penguin C and B platforms have benefited from four-stroke engine designs adapted from automotive origins, including Suzuki derivatives, providing improved fuel economy and operational flexibility for both defense and commercial customers.

Across Europe and Asia, companies are also investing in R&D to further enhance the performance envelope of Suzuki-based UAV engines, with a focus on electronic fuel injection, reduced emissions, and hybridization. Suzuki Motor Corporation itself has not formally entered the UAV market as a direct supplier, but its engines—especially the 1.2L and 1.3L four-cylinder gasoline series—are widely sourced for conversion kits by third-party aerospace specialists.

Looking ahead, competitive dynamics are expected to intensify as regulatory standards for UAV safety and emissions evolve, pushing major players to pursue certification, reliability testing, and integration of advanced digital controls. The entry of new companies from emerging markets, coupled with established automotive suppliers exploring UAV applications, is likely to drive further innovation and cost efficiency in Suzuki-engine propulsion solutions. The next few years may also see closer collaborations between Suzuki and aerospace integrators, as UAV demand for logistics, surveillance, and mapping continues to climb.

Suzuki’s Innovations: Engine Efficiency, Reliability & Hybridization

Suzuki’s engines, long recognized for their efficiency and reliability in the automotive sector, have increasingly become a foundation for innovative UAV propulsion systems. In 2025, the adaptation of Suzuki automotive engines—particularly the lightweight, fuel-efficient 3- and 4-cylinder gasoline and hybrid powerplants—has gained momentum among UAV manufacturers seeking robust, scalable solutions for medium-to-large unmanned aerial vehicles.

A core factor driving Suzuki’s relevance in UAV propulsion is the proven durability and operational consistency of its engines. These characteristics are critical in UAV applications, where reliability translates directly to mission success and safety. For instance, the Suzuki G13BB and G16B, both 4-cylinder gasoline engines originally designed for compact vehicles, have been successfully converted for UAV use by specialist integrators such as Pipistrel and Rotax, enabling extended flight durations and reduced maintenance intervals compared to traditional small aviation engines.

Suzuki’s recent ventures into hybridization are particularly notable. In 2025, the company continues to refine its dual-powertrain systems, pairing compact internal combustion engines with electric motors and advanced battery management. These hybrid setups are attractive for UAV OEMs seeking to blend the high energy density of liquid fuels with the instant responsiveness and redundancy of electric propulsion. Suzuki’s SHVS (Smart Hybrid Vehicle by Suzuki) system, although originally developed for ground vehicles, has been adapted by aerospace system integrators for vertical takeoff and landing (VTOL) UAVs, resulting in improved takeoff torque and enhanced in-flight efficiency. This approach is being explored by companies like Aurora Flight Sciences, which recognize the value of hybrid systems for both endurance and safety in autonomous missions.

- Suzuki engines’ modularity allows for relatively straightforward adaptation to UAV airframes, supporting both fixed-wing and rotary designs.

- Advanced engine management systems—such as Suzuki’s proprietary electronic fuel injection—permit precise control of fuel-air mixtures and optimize performance at varying altitudes, a key requirement in UAV operations.

- Hybrid Suzuki-based propulsion promises reduced emissions and lower operational costs, aligning with the global trend toward greener aviation technologies, as highlighted by ongoing projects at Suzuki Motor Corporation.

Looking forward, Suzuki’s continued R&D investment is expected to yield even lighter, more efficient engines with integrated hybrid capabilities tailored specifically for unmanned applications. As UAVs expand into cargo, surveillance, and urban mobility roles, Suzuki-engine propulsion systems—especially those featuring advanced hybridization—are poised to support the sector’s demand for efficiency, reliability, and adaptability.

Regulatory Environment and Certification Pathways

The regulatory environment governing Suzuki-engine UAV propulsion systems is evolving rapidly as civil and defense applications for unmanned aerial vehicles (UAVs) expand worldwide. In 2025, regulatory agencies such as the U.S. Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) are intensifying their focus on type certification, airworthiness standards, and environmental compliance for UAV propulsion systems, including those derived from automotive engines such as Suzuki’s.

Companies adapting Suzuki automotive engines for UAV use—such as Rotax and Austro Engine—must navigate newly harmonized certification pathways. EASA’s Special Condition for Light Unmanned Aircraft Systems (SC Light UAS) and the FAA’s Part 23 and Part 107 frameworks are central to these processes, with requirements that increasingly mirror those applied to manned aviation powerplants. Emphasis is placed on reliability, redundancy, and fail-safe operation, which demands modifications to original Suzuki engines, including dual ignition, redundant fuel systems, and advanced engine health monitoring.

In 2025, regulatory scrutiny is also mounting around emissions and noise. EASA has announced initiatives to assess and minimize the environmental impact of UAV propulsion systems, signaling a future in which Suzuki-engine UAVs must demonstrate compliance with stricter standards on hydrocarbon and NOx emissions, as well as decibel limits (European Union Aviation Safety Agency). These evolving requirements are guiding suppliers such as Suzuki Motor Corporation and integrators toward cleaner-burning, electronically controlled engine variants, and the adoption of advanced exhaust treatment technologies.

Certification timelines remain a challenge for Suzuki-engine UAV platforms, as the adaptation of automotive engines introduces unique validation requirements. The FAA’s recently updated Means of Compliance for Part 21.17(b) UAV systems mandates rigorous ground and flight testing, with particular focus on demonstrating engine reliability over extended operational cycles (Federal Aviation Administration). To support these efforts, specialized test centers and engineering consultancies with engine expertise, such as AVL List GmbH, are collaborating with OEMs to streamline the certification process.

Looking ahead, the regulatory environment will likely see continued tightening of standards, increased international harmonization, and the emergence of new pathways for certifying hybrid and alternative-fuel Suzuki-based UAV propulsion systems. Stakeholders are advised to engage proactively with regulators, leverage digital compliance tools, and invest in robust documentation and traceability systems to ensure timely market entry and sustained operational approval in the evolving landscape.

Key Partnerships, Collaborations, and Ecosystem Growth

The evolution of Suzuki-engine UAV propulsion systems has been marked by a significant increase in strategic partnerships and collaborations, particularly as the demand for high-reliability, fuel-efficient, and scalable powerplants for unmanned aerial vehicles (UAVs) accelerates into 2025 and beyond. Suzuki’s compact automotive engines, notably adapted for aviation by specialized integrators, have found a niche within medium- to heavy-lift UAV segments, leveraging their reputation for robust performance and global parts availability.

A pivotal player in this domain is MicroPilot, which has engaged in multiple collaborations with UAV manufacturers and engine integrators to enable Suzuki-based propulsion systems compatibility with advanced autopilots. Similarly, BRP-Rotax—while primarily known for its own engines—has partnered with system integrators and service providers to enable hybrid powertrains featuring Suzuki-derived or Suzuki-licensed engine blocks, especially for long-endurance UAVs. Additionally, UAV Factory (now part of EDGE Group) has developed and marketed propulsion modules leveraging automotive-derived engines, including those based on Suzuki platforms, targeting defense and commercial surveillance sectors.

In the supplier ecosystem, UE Systems and Carburetor Exchange have supplied specialized fuel and air management components tailored for Suzuki engine adaptations in UAV applications, ensuring compatibility with aviation-grade fuels and digital engine control systems. Meanwhile, Liebherr-Aerospace has supported integrators by providing lightweight engine accessories and cooling solutions suited for Suzuki-based UAV powerplants, further enhancing system reliability.

Industry-wide partnerships also extend to research and certification bodies. Organizations such as European Union Aviation Safety Agency (EASA) and Federal Aviation Administration (FAA) have seen increased engagement from Suzuki engine integrators, with joint efforts underway to standardize certification pathways for automotive-derived UAV engines, aiming to streamline regulatory approvals in both civil and dual-use markets.

Looking ahead to the next few years, the Suzuki-engine UAV propulsion ecosystem is expected to grow through expanded cross-sector partnerships. Anticipated developments include deeper integration of hybrid-electric architectures, with companies like Suzuki Motor Corporation itself exploring direct collaborations with UAV system integrators and international aerospace suppliers to accelerate the deployment of next-generation propulsion modules. This collaborative momentum is set to drive innovation, supply chain resilience, and regulatory harmonization, positioning Suzuki-engine UAV propulsion systems as a cornerstone of the evolving unmanned aviation landscape.

Challenges & Risks: Technical, Market, and Supply Chain Factors

Suzuki-engine UAV propulsion systems, leveraging automotive-derived internal combustion engines, are gaining attention for unmanned aerial vehicle (UAV) applications due to their cost-effectiveness and robust supply chains. However, the sector faces several technical, market, and supply chain challenges heading into 2025 and the years immediately beyond.

- Technical Challenges: Adapting Suzuki automotive engines for UAV propulsion involves significant engineering modifications. UAV applications demand reductions in weight, integration of advanced electronic control systems, and enhanced vibration damping. Maintaining reliability and efficiency at varying altitudes and in diverse atmospheric conditions poses ongoing hurdles. Additionally, compliance with evolving emissions and noise regulations is particularly critical for operations in environmentally sensitive areas. Companies such as Suzuki Motor Corporation and specialized integrators like BRP-Rotax GmbH & Co KG (for similar engine adaptation) are actively developing solutions, but these introduce complexity and may delay time-to-market for new UAV engine variants.

- Market Factors: The market for Suzuki-engine UAV propulsion systems is influenced by military and commercial demand cycles, which are sensitive to regulatory changes and end-user requirements. Shifts towards hybrid-electric and fully electric propulsion technologies, driven by net-zero targets and operational cost considerations, may limit the market share of traditional internal combustion solutions. UAV manufacturers and operators are closely monitoring the performance, maintenance, and lifecycle costs of Suzuki-based systems compared to emerging alternatives. Companies such as Yamaha Motor Co., Ltd. and Honda Motor Co., Ltd. are also developing UAV-specific engines, intensifying competition and pressuring Suzuki-based systems to demonstrate clear value propositions.

- Supply Chain Risks: Although Suzuki benefits from a global automotive supply base, UAV propulsion systems require specialized components and materials (e.g., lightweight alloys, custom avionics) that may be more vulnerable to geopolitical, logistical, or raw material disruptions. The ongoing realignment of supply chains in response to global events—such as semiconductor shortages and transportation bottlenecks—can lead to production delays or increased costs. Direct engagement with certified UAV suppliers, such as Uvionix Aerospace, is essential to ensure quality and continuity, but can introduce further complexity due to the need for aerospace-grade certification and traceability.

Looking ahead, Suzuki-engine UAV propulsion systems must overcome these intertwined technical, market, and supply chain challenges to remain competitive. Success will depend on continued collaboration with UAV manufacturers, adaptation to regulatory shifts, and investments in specialized engineering and supply chain resilience.

Future Outlook: Next-Gen Propulsion Technologies and Long-Term Opportunities

As the UAV (Unmanned Aerial Vehicle) sector evolves rapidly in 2025, Suzuki-engine-based propulsion systems are gaining renewed attention for both commercial and defense applications. Suzuki, renowned for its reliability and robust small-engine technology, has established a noteworthy footprint in UAV propulsion through partnerships and technology transfers. Recent years have seen Suzuki engines—particularly automotive-derived and motorcycle-engine derivatives—adapted for medium and large UAVs, where endurance, fuel efficiency, and maintainability are paramount.

In 2025, several propulsion system integrators are leveraging Suzuki’s four-stroke engines, valued for their balance between power output and fuel economy. Companies such as Rotax and Austro Engine have set industry benchmarks in the UAV propulsion segment with similar engine architectures, but Suzuki’s global manufacturing scale and proven reliability offer a compelling alternative, particularly for emerging UAV manufacturers seeking cost-effective yet robust solutions. Notably, Suzuki engines have been integrated into platforms such as the Turkish TUSAŞ Aksungur UAV, where a pair of automotive-based engines deliver high-altitude, long-endurance capability (Turkish Aerospace Industries).

Looking ahead, the next few years are expected to witness further refinements in Suzuki-based UAV propulsion. Hybridization is a key trend, with several integrators exploring the pairing of Suzuki internal combustion engines with electric powertrains to enable extended range and redundancy. This hybrid-electric approach is aligned with global UAV market demands for improved flight duration and lower lifecycle emissions. Suzuki’s ongoing investments in advanced fuel injection, electronic engine control units, and lightweight materials position it well to support these developments (Suzuki Motor Corporation).

Moreover, Suzuki’s extensive global service network offers a long-term advantage for UAV operators requiring reliable maintenance and spare parts, particularly in regions with limited aviation infrastructure. As regulatory frameworks become more favorable to commercial UAV operations, especially in logistics and surveillance, demand for proven, mass-produced engine platforms is likely to rise.

In summary, Suzuki-engine propulsion systems are poised for greater adoption in UAVs through 2025 and beyond, driven by their cost-effectiveness, reliability, and adaptability for next-generation hybrid and heavy-fuel configurations. As strategic partnerships between engine manufacturers, UAV OEMs, and integrators deepen, Suzuki’s role in the evolving UAV propulsion landscape is set to expand, supporting both legacy and emerging applications in the global UAV market.

Sources & References

- Austro Engine

- UESystems

- Maruhon Inc.

- Aviation Industry Corporation of China (AVIC)

- Suzuki Motor Corporation

- European Union Aviation Safety Agency

- Stemme AG

- Suzuki Motor Corporation

- Austro Engine GmbH

- Ukrspecsystems

- Pipistrel

- Aurora Flight Sciences

- AVL List GmbH

- MicroPilot

- Liebherr-Aerospace

- Yamaha Motor Co., Ltd.

- Uvionix Aerospace

- Turkish Aerospace Industries