- Rocket Lab reported $123 million in revenue but faced a $30 million loss, highlighting the challenges of the space industry.

- The company exceeded gross margin projections, reflecting efficient resource management and operations.

- Five successful launches generated $36 million, while the space systems division significantly contributed $87 million with a $645 million order backlog.

- Next quarter revenue is projected between $130 million and $140 million, with expectations of continued losses.

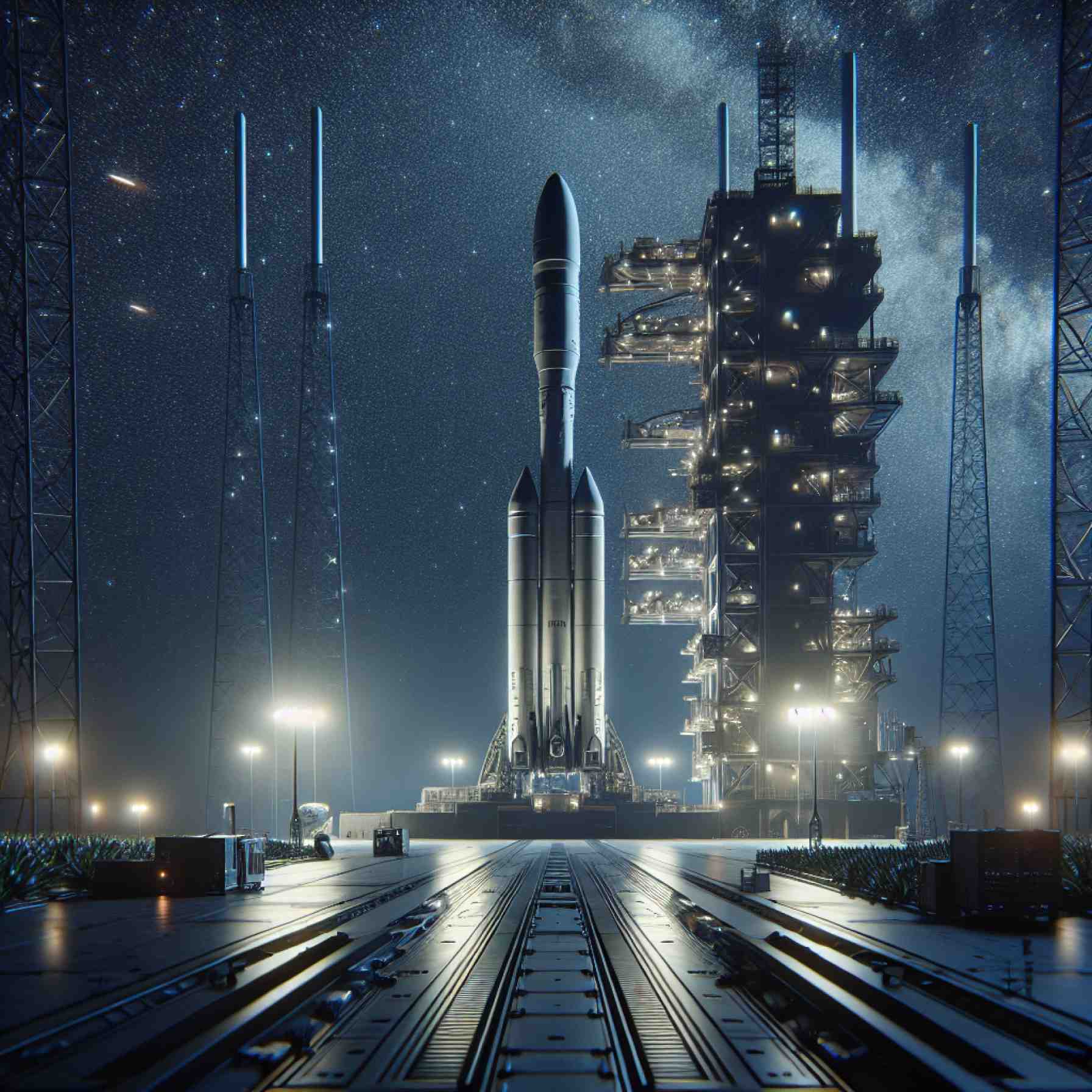

- The upcoming launch of the Neutron rocket, supported by the U.S. Air Force, is anticipated to enhance Rocket Lab’s position in space exploration.

- Rocket Lab represents a blend of high ambition and cautious realism, inviting investors to explore its evolving potential.

Rocket Lab’s latest chapter unveils a world of oscillating fortunes, poised unknowns, and bold ambitions, embodying the space industry’s high-stakes dance. Known for its ingenious strides and palpable boldness, the Californian space company, Rocket Lab, finds itself at a precipice where expectations and realities form a complex tapestry.

Recent figures sketch a portrait of growth tinged with caution. Revenue hit $123 million, aligning snugly with the anticipated figures, yet not without a $30 million loss casting its shadow—a reality check served by the rigors of space exploration. Still, a brighter note emanates from the company’s gross margin exceeding projections, a testament to Rocket Lab’s deft handling of its resources and operations.

A vivid narrative unfolds in the skies, where Rocket Lab executed five successful launches that fueled a $36 million revenue contribution. Meanwhile, its space systems division shone brightly, pulling in $87 million and maintaining a robust backlog of $645 million in orders, promising journeys yet to embark.

Projections for the next quarter reveal a more tempered outlook. While the company forecasts revenues between $130 million and $140 million, investor anticipations hover at a wistful $137 million, a microcosm of the broader industry’s balancing act between aspiration and feasibility. This cautious hesitance extends to expected losses, predicted to loom larger than some had hoped.

And yet, amidst these scattered clouds, the horizon is dotted with stars of untold potential. The Neutron rocket, a technological marvel poised to redefine payload capabilities, stands ready for its premier launch later this year. Its initial mission—endorsed by none other than the U.S. Air Force—promises to propel Rocket Lab into a fresh echelon of space exploration.

Seasoned investors and fledgling enthusiasts alike find themselves at a crossroads with Rocket Lab. The enticement of a yet-unrevealed future versus the immediacy of numbers that don’t always dazzle creates a resonant tension. Yet, for those willing to weather the storm, the promise of revolutionary leaps remains near at hand.

In this extraordinary tapestry of space exploration, Rocket Lab persists—a custodian of dreams, an architect of future terrains, inviting those who dare to dream with it, to grasp the expansive skies.

Rocket Lab’s Bold Frontier: Balancing Growth with Caution in Space Exploration

Overview

Rocket Lab, a trailblazer within the space industry, stands at a critical juncture, exemplifying the intricate balance between audacious ambition and the challenging realities of space ventures. While the company’s revenue saw significant growth, achieving $123 million, this success was overshadowed by a $30 million loss. This juxtaposition highlights the inherent financial risks of space exploration, where innovation often outpaces immediate returns.

Key Insights

– Revenue and Loss Analysis: Rocket Lab’s revenue aligns with expectations, yet a $30 million loss reveals underlying financial challenges. However, the company’s gross margin exceeds projections, showcasing effective resource and operational management.

– Launch Success and Space Systems Performance: The company successfully executed five launches contributing $36 million to its revenue. Additionally, its space systems division proves robust, bringing in $87 million and holding a $645 million order backlog, indicating strong future potential.

– Forecasts and Market Expectations: For the next quarter, Rocket Lab forecasts revenues between $130 million and $140 million. However, investor expectations are slightly lower at $137 million, reflecting cautious optimism that mirrors industry-wide sentiments.

– Neutron Rocket and Future Prospects: The imminent launch of the Neutron rocket, with its technologically advanced payload capabilities, is set to usher Rocket Lab into a new era. Notably, its initial mission backed by the U.S. Air Force underscores the rocket’s strategic importance.

Deep Dive: The Neutron Rocket

The Neutron rocket promises to revolutionize payload capabilities with its innovative design. Intended as a workhorse for future missions, its development is crucial for Rocket Lab’s strategic positioning. The U.S. Air Force partnership signals strong government confidence, potentially unlocking lucrative defense contracts.

Industry Trends and Predictions

– Space Industry Growth: The space industry is projected to grow exponentially, with an estimated valuation of $1 trillion by 2040, driven by increasing satellite launches and deep-space missions.

– Competition and Innovation: Major players like SpaceX and Blue Origin are pushing the boundaries of reusability and cost-efficiency. Rocket Lab must innovate continually to maintain its competitive edge.

– Sustainability Focus: As environmental concerns rise, rocket companies are exploring eco-friendly propulsion systems. Rocket Lab’s sustainability efforts will be vital in aligning with global environmental goals.

Core Questions Answered

1. What is Rocket Lab’s strategy for overcoming financial losses?

Rocket Lab is focusing on expanding its commercial and defense contracts, leveraging technological innovations to enhance efficiency and lower costs over time.

2. How competitive is the Neutron rocket in the current market?

The Neutron rocket is highly competitive, designed to cater to large payload deliveries. Its governmental endorsement enhances its market appeal, offering a robust alternative to existing heavy-lift launchers.

3. What challenges does Rocket Lab face?

Key challenges include managing financial losses, sustaining a growth trajectory amidst stiff competition, and advancing technological innovation to remain relevant.

Actionable Recommendations

– Investment Considerations: For investors, evaluate the long-term growth potential versus short-term volatility. Rocket Lab’s strategic government partnerships and technological advancements may offer significant future returns.

– Keeping Abreast of Developments: Stay informed on Rocket Lab’s upcoming launches and financial outcomes to gauge company trajectory and industry positioning.

– Engage with Industry Discussions: Participate in space industry forums and seminars to gain insights into market dynamics and Rocket Lab’s evolving role.

For more information, visit the official Rocket Lab website.

In conclusion, Rocket Lab represents a microcosm of the larger space industry’s complexities, characterized by visionary ambition and intricate economic challenges. As the company propels forward, its journey offers a compelling narrative of exploration, risk, and potential reward for those bold enough to dream beyond the stars.