- Rocket Lab USA’s stock prices have surged by over 300% in 2024, indicating strong investor interest.

- The company has launched 63 of its Electron rockets by April 2025, establishing itself as a reliable player in the commercial space industry.

- With the upcoming Neutron rocket, Rocket Lab aims to compete with industry giants by targeting medium-lift reusable launches for satellite and interplanetary missions.

- Despite current financial losses, Rocket Lab has substantial cash reserves of $517 million to fuel continued R&D, particularly the Neutron project.

- Being part of the U.S. Department of Defense’s National Security Space Launch program and securing a NASA contract underscores Rocket Lab’s growing capabilities.

- The global space economy is projected to reach $1 trillion by 2040, presenting lucrative opportunities for Rocket Lab and its investors.

- Rocket Lab is a promising, albeit high-risk, investment option in the growing space exploration market.

Rocket Lab USA has taken the investment world by storm, with its stock prices soaring over 300% in 2024. While the subsequent year brought a stabilization in stock value, the company’s operational momentum shows no signs of slowing.

A cornerstone of Rocket Lab’s portfolio is the Electron rocket, which has already achieved 63 launches by April 2025. This high-frequency, small satellite launcher has become synonymous with reliability in the burgeoning commercial space industry. With expectations of over 10,000 small satellite launches by 2030, Rocket Lab finds itself in a prime position to satisfy this demand.

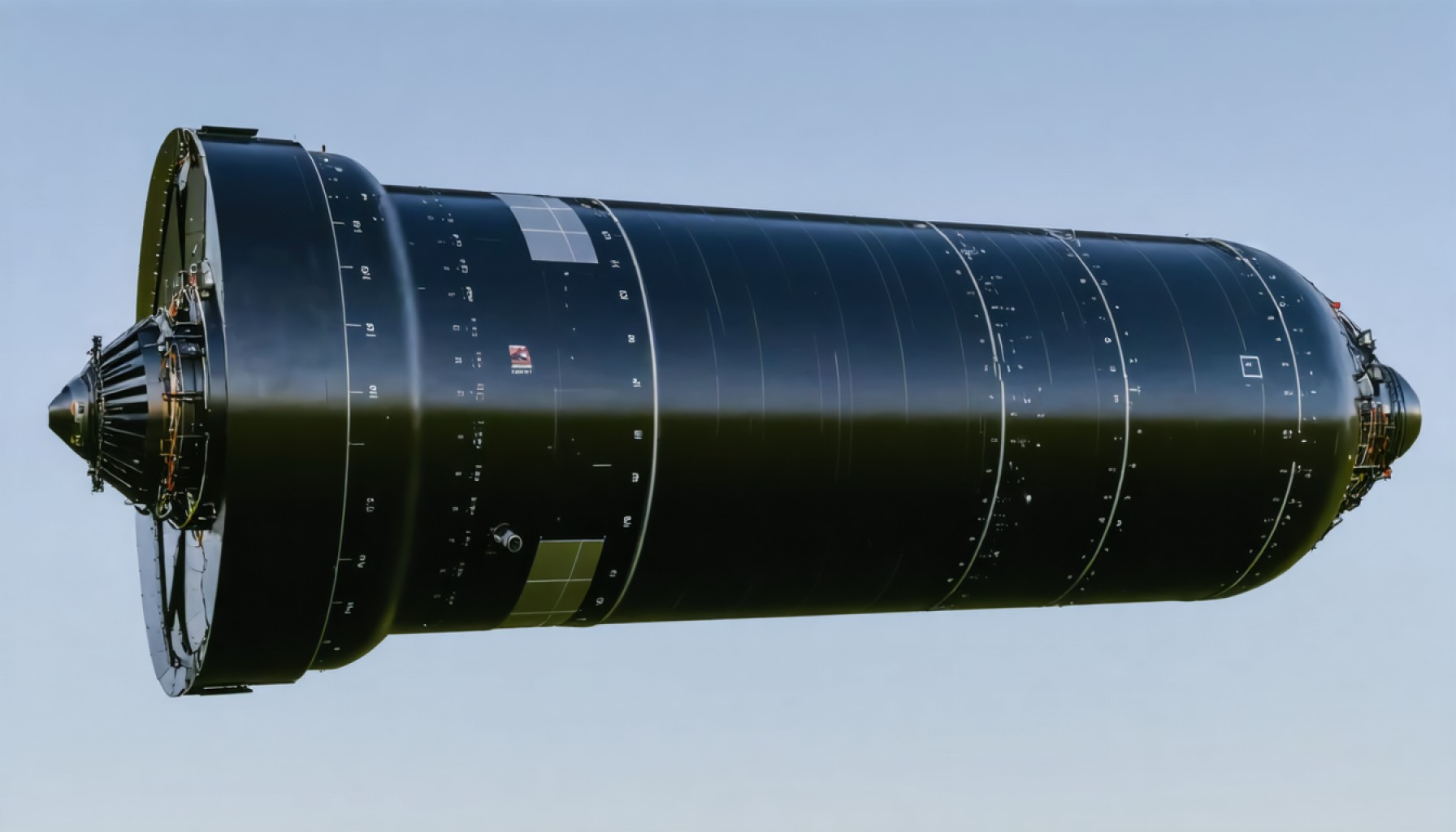

Yet, it’s the upcoming debut of the Neutron rocket that truly captures the imagination. Neutron, a medium-lift reusable launch vehicle, aspires to transport humanity beyond just Earth orbit, with potential applications in satellite constellation deployments and even interplanetary missions. Scheduled for its first flight in late 2025, Neutron symbolizes Rocket Lab’s strategic maneuver to compete directly with industry heavyweights like SpaceX.

Despite operating in the red with a market cap of $11.5 billion and an adventurous price-to-sales ratio of 25, Rocket Lab stands as a bold growth opportunity. Its Q1 2025 financials revealed revenue reaching $123 million—a 32% year-over-year increase. Although losses widened, the company’s substantial cash reserves of $517 million enable it to continue its ambitious R&D endeavors, most notably the Neutron project.

Recent achievements add further credibility to Rocket Lab’s expanding capabilities. The inclusion in the U.S. Department of Defense’s $5.6 billion National Security Space Launch program, alongside a NASA contract for the Aspera mission to explore the intergalactic medium, signal its growing reputation as a formidable partner for advanced missions.

Looking ahead, the prospects in the space sector appear dazzlingly vast, with Morgan Stanley forecasting a $1 trillion global space economy by 2040. Rocket Lab’s strategic positioning within this booming market presents a tempting prospect for investors eager to bet on future technological frontiers.

While challenges remain, particularly the execution risks surrounding the Neutron launch, Rocket Lab’s blend of innovation and strategic foresight suggests it may indeed be a star player in our cosmic future. For investors with the appetite for high risk, Rocket Lab offers not just a stake in a company, but a piece of the final frontier.

Rocket Lab’s Rise: What to Know About the Next Space Frontier Leader

Rocket Lab’s Strategic Position in the New Space Race

Rocket Lab USA has garnered significant attention in the investment world, marking an impressive increase of over 300% in stock prices in 2024. This growth highlights the company’s increasing influence in the space industry, yet there’s much more beneath the surface to consider.

Neutron Rocket: A Game-Changer in Space Exploration

The anticipated Neutron rocket represents a significant milestone for Rocket Lab. Scheduled for its inaugural flight in late 2025, Neutron is a reusable, medium-lift launch vehicle designed to compete directly with SpaceX’s Falcon 9. Key potential applications include satellite constellation deployments and even missions extending beyond Earth orbit. This strategic maneuver allows Rocket Lab to capture a broader market share in an industry expecting over 10,000 small satellite launches by 2030.

Electron Rocket: The Backbone of Small Satellite Launches

By April 2025, Rocket Lab’s Electron rocket had achieved 63 successful launches, underscoring its reputation for reliability. It primarily serves the booming commercial space industry, adeptly satisfying the needs for small satellite transportation through its high-frequency launch capability. This aligns well with the expected market demand, positioning Rocket Lab as a leader in the small satellite sector.

Financial Health and Strategic Investments

Despite reporting widened losses, Rocket Lab maintains a strong financial footing with $517 million in cash reserves—a critical factor in funding its ambitious R&D initiatives, like the Neutron project. With a market capitalization of $11.5 billion and a price-to-sales ratio of 25, its Q1 2025 revenue hit $123 million, portraying a 32% increase year-over-year.

To ensure continued innovation and market relevancy, Rocket Lab has secured significant contracts, including participation in the U.S. Department of Defense’s $5.6 billion National Security Space Launch program and a NASA contract for the Aspera mission. These strategic collaborations reinforce its role as a trusted partner in advanced space missions.

Market Trends: A Triumphant Future Ahead

The space sector forecasts are exceptionally optimistic. Morgan Stanley projects a $1 trillion global space economy by 2040, reflective of the industry’s vast potential. Rocket Lab’s calculated positioning within this expanding market offers a compelling narrative to investors willing to embrace the inherent risks of the sector.

Key Reader Questions and Answers

1. How does Rocket Lab compare to SpaceX?

While Rocket Lab specializes in smaller payloads with its Electron rocket, the upcoming Neutron rocket directly positions it against SpaceX’s Falcon 9. Both companies focus on reusability and cost-effectiveness, yet SpaceX currently serves heavier payloads and larger missions.

2. What are the major risks of investing in Rocket Lab?

Key risks include execution challenges with the new Neutron rocket and maintaining financial stability as expenses rise. However, its growing reputation and strategic contracts mitigate some of these worries.

3. Will Rocket Lab remain competitive in the long term?

Yes, due to its innovative technology, strategic industry partnerships, and the burgeoning demand for satellite launches. Long-term growth depends on successfully launching and operating Neutron.

Actionable Tips for Interested Investors

– Diversify Your Investment: If considering investing, diversify to minimize risks associated with new technology ventures.

– Monitor Industry Trends: Keep an eye on broader space industry forecasts and competitive movements.

– Consider Expert Opinions: Consult with financial advisors or industry experts to gauge Rocket Lab’s potential within your investment strategy.

For more insights into Rocket Lab and the evolving space economy, visit the Rocket Lab website.