Hyperspectral Eyes in the Sky: Unveiling the Next Frontier in Space-Based Earth Monitoring

- Market Overview: The Expanding Role of Hyperspectral Imaging in Space

- Technology Trends: Innovations Driving Space-Based Hyperspectral Sensing

- Competitive Landscape: Key Players and Strategic Moves

- Growth Forecasts: Projections for Market Expansion

- Regional Analysis: Geographic Hotspots and Adoption Patterns

- Future Outlook: Emerging Applications and Market Evolution

- Challenges & Opportunities: Navigating Barriers and Unlocking Potential

- Sources & References

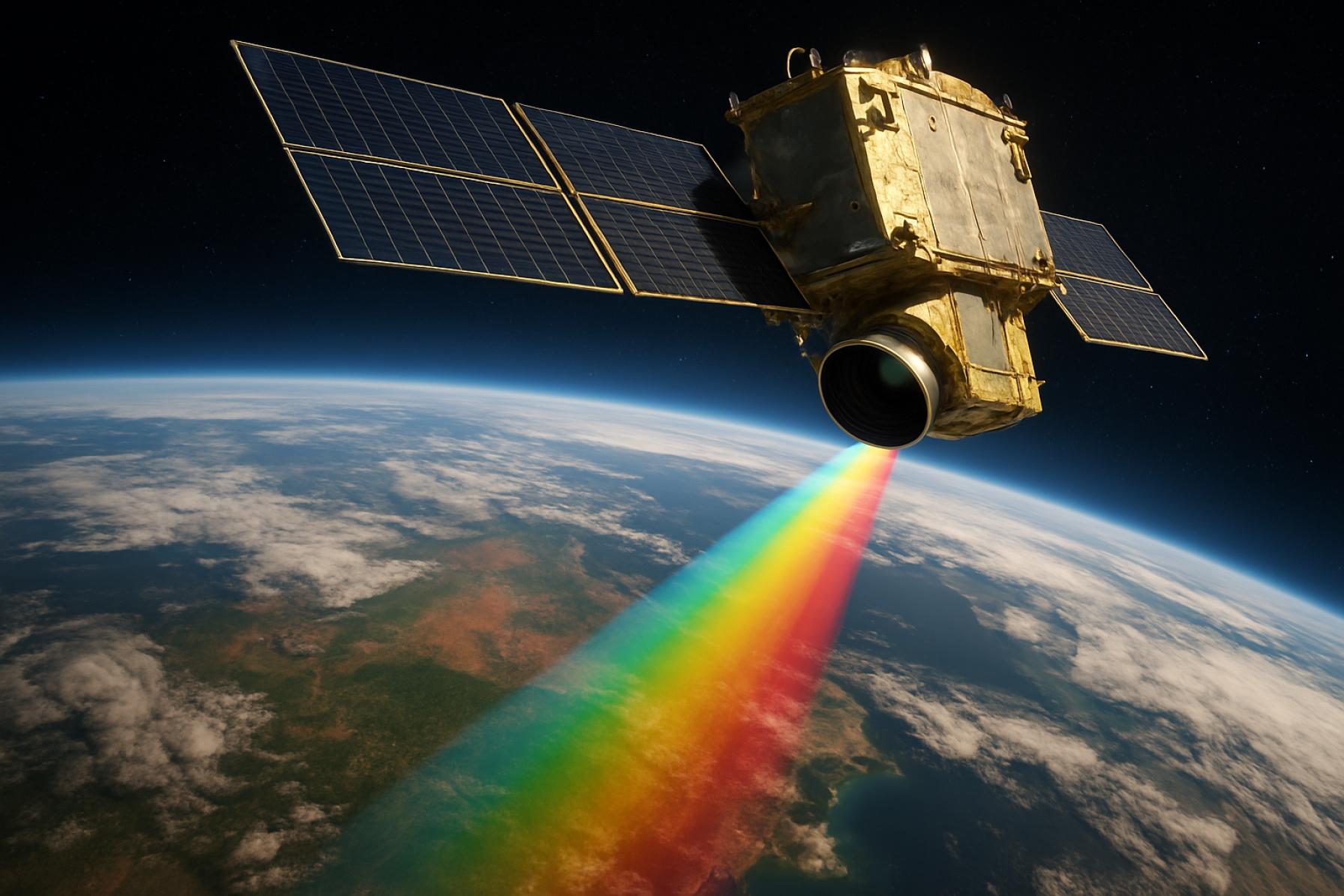

“Imagine a satellite that not only takes pictures of Earth, but can also identify what materials compose each pixel of the image.” (source)

Market Overview: The Expanding Role of Hyperspectral Imaging in Space

Hyperspectral imaging (HSI) in space is rapidly transforming the landscape of Earth observation, offering unprecedented detail and accuracy across a wide range of applications. Unlike traditional multispectral sensors, hyperspectral sensors capture data across hundreds of contiguous spectral bands, enabling the identification and analysis of materials, vegetation, water quality, and even atmospheric gases with remarkable precision.

The global market for space-based hyperspectral imaging is experiencing robust growth. According to a recent report, the hyperspectral imaging market is projected to reach USD 34.3 billion by 2028, growing at a CAGR of 18.3% from 2023 to 2028. This surge is driven by increasing demand for high-resolution, real-time data in sectors such as agriculture, environmental monitoring, mineral exploration, and defense.

- Agriculture: Hyperspectral satellites enable precision farming by monitoring crop health, detecting diseases, and optimizing irrigation. Companies like Planet Labs and Satellogic are leveraging HSI to provide actionable insights for farmers and agribusinesses.

- Environmental Monitoring: HSI is crucial for tracking deforestation, mapping wetlands, and assessing water quality. The PRISMA mission by the Italian Space Agency and the upcoming NASA Surface Biology and Geology (SBG) mission exemplify the growing investment in hyperspectral capabilities for environmental stewardship.

- Mineral Exploration: Mining companies are increasingly using hyperspectral data to identify mineral deposits and reduce exploration costs. The ESA’s Proba-V and commercial ventures like HySpecIQ are at the forefront of this trend.

- Defense and Security: Governments are investing in HSI for surveillance, target identification, and disaster response. The Hyperion sensor on NASA’s EO-1 satellite demonstrated the value of hyperspectral data for military and intelligence applications.

As the cost of launching small satellites continues to fall and sensor technology advances, the accessibility and utility of hyperspectral imaging are set to expand further. The integration of artificial intelligence and cloud-based analytics is also accelerating the extraction of actionable insights from vast hyperspectral datasets, making “hyperspectral eyes in the sky” a cornerstone of the next generation of Earth observation (SpaceNews).

Technology Trends: Innovations Driving Space-Based Hyperspectral Sensing

Space-based hyperspectral imaging is rapidly transforming the landscape of Earth observation, offering unprecedented detail and accuracy in monitoring our planet. Unlike traditional multispectral sensors, which capture data in a handful of broad wavelength bands, hyperspectral sensors collect information across hundreds of narrow, contiguous spectral bands. This enables the detection of subtle differences in surface materials, vegetation health, water quality, and atmospheric composition, making hyperspectral imaging a game-changer for applications ranging from agriculture to climate science.

Recent technological advancements have made it feasible to deploy hyperspectral sensors on small satellites and constellations, significantly increasing revisit rates and global coverage. For example, Planet Labs and Satellogic are among the commercial players launching hyperspectral payloads, while government agencies like NASA and ESA continue to invest in flagship missions such as EnMAP and AVIRIS.

According to a 2023 report by MarketsandMarkets, the global hyperspectral imaging market is projected to reach $34.3 billion by 2028, driven largely by demand for space-based applications. Key innovations fueling this growth include miniaturized sensor designs, on-board AI for real-time data processing, and advanced data compression techniques that enable efficient downlink of massive hyperspectral datasets.

- Precision Agriculture: Hyperspectral satellites can detect crop stress, disease, and nutrient deficiencies at early stages, enabling targeted interventions and improved yields (Nature).

- Environmental Monitoring: These sensors are critical for tracking deforestation, mapping mineral resources, and monitoring water bodies for pollution or harmful algal blooms (MDPI).

- Disaster Response: Hyperspectral data supports rapid assessment of wildfire damage, oil spills, and flood impacts, improving emergency response and recovery efforts (Frontiers).

As launch costs decrease and sensor technology matures, hyperspectral “eyes in the sky” are poised to become a cornerstone of Earth observation, delivering actionable insights for governments, businesses, and researchers worldwide.

Competitive Landscape: Key Players and Strategic Moves

The competitive landscape for space-based hyperspectral imaging is rapidly evolving, driven by technological advancements and increasing demand for high-resolution, multi-band Earth observation data. Hyperspectral imaging satellites, often referred to as “hyperspectral eyes in the sky,” capture data across hundreds of spectral bands, enabling unprecedented insights for applications such as agriculture, environmental monitoring, mineral exploration, and defense.

Key Players

- Planet Labs: Known for its large fleet of Earth observation satellites, Planet Labs is expanding into hyperspectral imaging with its Pelican and Tanager missions, aiming to provide high-frequency, high-resolution hyperspectral data for commercial and government clients.

- Satellogic: This Argentina-based company is deploying a constellation of satellites equipped with hyperspectral sensors, targeting applications in agriculture, forestry, and infrastructure monitoring. As of early 2024, Satellogic operates over 40 satellites and plans to expand further (Satellogic Newsroom).

- HyperScout (by cosine): HyperScout’s miniaturized hyperspectral imagers are being integrated into various small satellite missions, including those by the European Space Agency (ESA), to deliver real-time analytics for disaster response and environmental monitoring (cosine).

- Maxar Technologies: While traditionally focused on high-resolution optical imagery, Maxar is investing in hyperspectral capabilities to enhance its geospatial intelligence offerings (Maxar News).

- European Space Agency (ESA): ESA’s CHIME mission, scheduled for launch in 2025, will provide free and open hyperspectral data for scientific and commercial use.

Strategic Moves

- Partnerships and Collaborations: Companies are forming alliances with analytics firms and cloud providers to deliver actionable insights from hyperspectral data. For example, Planet Labs partners with Microsoft’s AI for Earth to enhance data accessibility and analysis.

- Vertical Integration: Firms like Maxar and Satellogic are investing in end-to-end solutions, from satellite manufacturing to data analytics, to capture more value across the supply chain.

- Government Contracts: Hyperspectral imaging is increasingly vital for defense and intelligence, with agencies such as NASA and the U.S. National Reconnaissance Office (NRO) awarding contracts to commercial providers (SpaceNews).

As the market matures, competition is intensifying, with new entrants and established players racing to deploy advanced hyperspectral sensors and analytics platforms. The result is a dynamic ecosystem poised to transform how we observe and understand our planet.

Growth Forecasts: Projections for Market Expansion

Hyperspectral imaging from space is rapidly transforming the Earth observation (EO) market, offering unprecedented detail across hundreds of spectral bands. This technology enables applications ranging from precision agriculture and mineral exploration to environmental monitoring and defense. The global hyperspectral imaging market, valued at approximately USD 16.8 billion in 2023, is projected to reach USD 34.3 billion by 2028, growing at a CAGR of 15.2%.

Space-based hyperspectral systems are a key driver of this growth. The number of commercial hyperspectral satellites is expected to surge, with over 100 launches planned by 2027, according to SpaceNews. Companies like HySpecIQ, Planet Labs, and ICEYE are investing heavily in new constellations, aiming to deliver high-resolution, high-frequency data to a broadening customer base.

- Precision Agriculture: Hyperspectral data enables farmers to monitor crop health, optimize irrigation, and detect disease earlier than traditional imaging. The agricultural analytics segment is forecast to grow at over 18% CAGR through 2030 (Grand View Research).

- Environmental Monitoring: Governments and NGOs are leveraging hyperspectral imagery to track deforestation, water quality, and pollution. The environmental monitoring market is expected to see double-digit growth as climate change drives demand for actionable insights (GlobeNewswire).

- Defense and Security: Military and intelligence agencies are major adopters, using hyperspectral data for surveillance, target identification, and disaster response. The defense segment is anticipated to maintain a significant market share through 2028 (MarketsandMarkets).

As launch costs decrease and data processing capabilities improve, hyperspectral imaging is poised for mainstream adoption. The convergence of AI, cloud computing, and satellite miniaturization will further accelerate market expansion, making “hyperspectral eyes in the sky” a cornerstone of the next generation of Earth observation.

Regional Analysis: Geographic Hotspots and Adoption Patterns

Space-based hyperspectral imaging is rapidly transforming the landscape of Earth observation, with certain geographic regions emerging as hotspots for adoption and innovation. Hyperspectral sensors, which capture data across hundreds of spectral bands, enable unprecedented insights into agriculture, forestry, mineral exploration, environmental monitoring, and defense. The global market for hyperspectral imaging is projected to reach USD 34.3 billion by 2028, with a significant portion driven by satellite-based applications.

- North America: The United States leads in both technological development and commercial deployment of hyperspectral satellites. NASA and private companies like Planet Labs and HySpecIQ are at the forefront, launching constellations that provide high-resolution, frequently updated hyperspectral data. The U.S. government’s investment in climate monitoring and precision agriculture further accelerates adoption.

- Europe: The European Space Agency (ESA) and national agencies are investing heavily in hyperspectral missions, such as the CHIME mission (Copernicus Hyperspectral Imaging Mission for the Environment), set to launch in 2026. European startups and research institutions are leveraging this data for sustainable agriculture, water quality monitoring, and urban planning.

- Asia-Pacific: China and India are rapidly expanding their hyperspectral capabilities. China’s GF-5 satellite series and India’s HySIS (Hyperspectral Imaging Satellite) are providing critical data for resource management and disaster response. The region’s focus on food security and environmental protection is driving government and commercial investment.

- Rest of the World: Emerging economies in Latin America and Africa are beginning to access hyperspectral data through international partnerships and commercial providers. These regions are using the technology for monitoring deforestation, crop health, and water resources, though adoption is currently limited by infrastructure and funding constraints.

Overall, the adoption of space-based hyperspectral imaging is most advanced in North America and Europe, with Asia-Pacific rapidly catching up. As launch costs decrease and data accessibility improves, more regions are expected to leverage hyperspectral “eyes in the sky” for a wide range of applications, fundamentally reshaping how we observe and manage our planet.

Future Outlook: Emerging Applications and Market Evolution

Space-based hyperspectral imaging is rapidly transforming the landscape of Earth observation, offering unprecedented detail and versatility for a wide range of applications. Unlike traditional multispectral sensors, hyperspectral systems capture hundreds of contiguous spectral bands, enabling the detection of subtle differences in surface materials, vegetation health, water quality, and more. This technological leap is driving a new era of data-driven decision-making across industries and governments.

Emerging Applications

- Agriculture: Hyperspectral satellites are enabling precision agriculture by monitoring crop health, detecting disease outbreaks, and optimizing irrigation. Companies like Planet and Satellogic are deploying constellations to deliver actionable insights to farmers and agribusinesses.

- Environmental Monitoring: These sensors are crucial for tracking deforestation, mapping biodiversity, and assessing the impacts of climate change. The European Space Agency’s Copernicus program is integrating hyperspectral data to enhance environmental monitoring capabilities.

- Mineral Exploration: Hyperspectral imaging can identify mineral compositions from orbit, reducing the need for costly ground surveys. Startups like Asterra are leveraging this technology for resource exploration and infrastructure monitoring.

- Disaster Response: Rapid assessment of wildfires, floods, and oil spills is possible with hyperspectral data, improving emergency response and mitigation strategies (NASA Earth Observatory).

Market Evolution and Growth

The global hyperspectral imaging market is projected to reach $34.3 billion by 2028, growing at a CAGR of 18.5% from 2023. The proliferation of small satellites and advances in onboard processing are reducing costs and increasing data accessibility. Major players such as Maxar Technologies and Airbus are investing heavily in next-generation hyperspectral payloads.

As cloud-based analytics and AI-driven interpretation mature, the value of hyperspectral data will continue to rise, unlocking new commercial and scientific opportunities. The convergence of these trends positions space-based hyperspectral imaging as a cornerstone of the future Earth observation ecosystem.

Challenges & Opportunities: Navigating Barriers and Unlocking Potential

Hyperspectral imaging from space is rapidly transforming the landscape of Earth observation, offering unprecedented detail across hundreds of spectral bands. This technology enables the detection of subtle changes in vegetation health, mineral composition, water quality, and even urban infrastructure, far surpassing the capabilities of traditional multispectral sensors. However, the path to widespread adoption is marked by both significant challenges and promising opportunities.

- Technical Barriers: Hyperspectral sensors generate massive volumes of data—often terabytes per day per satellite. This creates bottlenecks in data transmission, storage, and processing. Advanced onboard compression and edge computing are being developed to address these issues, but the need for robust ground infrastructure remains a hurdle (NASA).

- Cost and Accessibility: The high cost of hyperspectral payloads and launches has historically limited access to government agencies and large corporations. However, the rise of small satellite constellations and commercial providers is driving down costs. Companies like Planet and HySpecIQ are pioneering affordable, high-frequency hyperspectral data services.

- Data Interpretation: Extracting actionable insights from hyperspectral data requires sophisticated algorithms and machine learning models. The lack of standardized processing pipelines and the need for expert interpretation can slow adoption. Collaborative efforts, such as the ESA’s CHIME mission, are working to develop open-source tools and shared datasets.

- Regulatory and Privacy Concerns: As hyperspectral imaging can reveal detailed information about land use and resources, it raises questions about data privacy and national security. Policymakers are beginning to address these issues, but clear international frameworks are still evolving (Nature).

Despite these challenges, the opportunities are vast. The global hyperspectral imaging market is projected to reach $34.3 billion by 2028, driven by applications in agriculture, mining, environmental monitoring, and defense. As technology matures and barriers are addressed, hyperspectral “eyes in the sky” are poised to unlock new insights into our planet, enabling smarter decision-making and more sustainable resource management.

Sources & References

- Hyperspectral Eyes in the Sky: How Space-Based Imaging Is Revolutionizing Earth Observation

- $34.3 billion by 2028

- Planet

- Satellogic

- ESA’s CHIME mission

- NASA

- Copernicus program

- SpaceNews

- Nature

- Frontiers

- cosine

- Maxar Technologies

- Microsoft’s AI for Earth

- HySpecIQ

- ICEYE

- Grand View Research

- GlobeNewswire

- GF-5 satellite

- HySIS

- Asterra

- NASA Earth Observatory

- Airbus